For example, an invoice for $1,000 could be settled for $980 if it’s paid within 10 days.

STANDARD ACCOUNTS RECEIVABLE PAYMENT TERMS FULL

Payment in advance: Deposit or payment made by a customer before work starts on a project.The Five Most Common Invoice Payment Terms Payment terms are essential when negotiating a contract, and they should maximize how quickly your clients pay you while minimizing inconvenience for your customer.

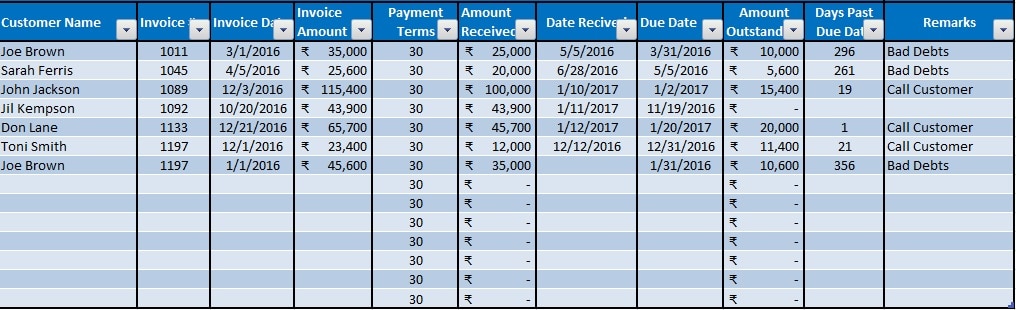

Invoice payment terms allow you to make accurate cash flow projections, which in turn help you plan for taxes and manage the growth of your business. They are an agreement that sets your expectations for payment, including when your client needs to pay you and the penalties for missing a payment. Invoice payment terms are the conditions that outline how, when, and by what method your customers or clients will provide payment to your business.

0 kommentar(er)

0 kommentar(er)